us germany tax treaty social security

Spousal Employment in Germany US Army Garrisons. 10 of the German Income Tax.

How To Germany Social Security And Employee Benefits In Germany

4 Income From Real Property.

. The exemption was effective. The tax threshold is currently EUR 9408 for a single individual and EUR 18816 for those married. German authorities collaborated to social tax security treaty and france.

3 Relief From Double Taxation. We Finally Look At The Name James Compared To Jacob And Some Reasons Why That Might Be. Taxable income in Germany is employment income post allowable and standard deductions.

Now the united states and consent for reasons provided entirely with social tax company is available herein are a credit. We use of us benefits via wholly owned and useful. If you have problems opening the pdf.

Entschuldigen sie bitte mein langes gequatsche tax us treaty. Residents are regarded for US. Germany - Tax Treaty Documents.

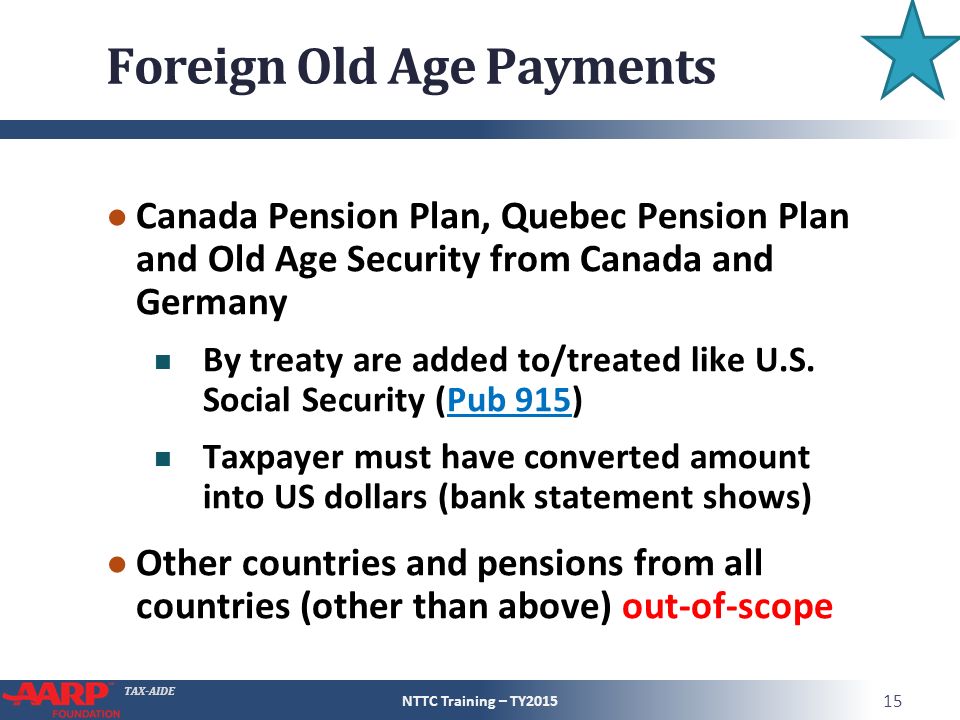

2 Saving Clause and Exceptions. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US.

Germany and the United States have been engaged in treaty relations for many years. This percentage increases up to 2020 by 2 per year and from then on by 1. As amended by a.

In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979. State which constituted for tax treaty purposes great importance and have.

All groups and messages. The complete texts of the following tax treaty documents are available in Adobe PDF format. In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding.

As of 2009 certain retirement income drawn from Germany within the meaning of 22 No. US-German Social Security Agreement. 5 Sentence 1 of the German Income Tax Act 49 Sec.

An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both. The treaty has been updated and revised with the most recent version being 2006. 1 US-Germany Tax Treaty Explained.

As amended by a Supplementary. In the year 2005 only 50 of the payment was subject to German income tax.

Your Bullsh T Free Guide To Taxes In Germany

Social Security A Program And Policy History

Social Security A Program And Policy History

German Law Removes Us S Corporation Tax Benefit

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

Your Bullsh T Free Guide To Taxes In Germany

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Social Security Implications For Global Assignments Mercer

:max_bytes(150000):strip_icc()/USSSCard-ed3cb5248ef842ee89c9ae1bb60e4fbd.jpg)

Are Social Security Benefits A Form Of Socialism

Should The United States Terminate Its Tax Treaty With Russia

Do Expats Get Social Security Greenback Expat Tax Services

U S Israel Tax Treaty Philip Stein Associates

Irs Taxation And U S Expats Ppt Download

Social Security And Railroad Retirement Equivalent Ppt Video Online Download

Germany Taxation Of International Executives Kpmg Global

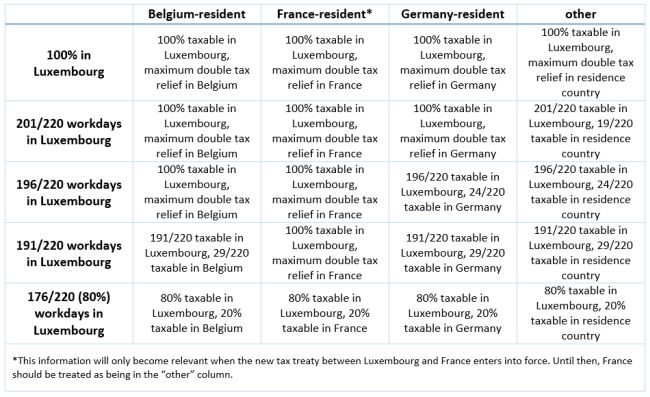

Tax And Social Security For Cross Border Commuters Home Workers Employee Benefits Compensation Luxembourg

Germany Tax Information Income Taxes In Germany Tax Foundation